An efficient Procure-to-Pay (P2P) process is critical for optimizing spending, improving supplier relationships, and maintaining financial control. As organizations face increasing pressure to reduce costs and streamline operations, the ability to manage the entire procurement lifecycle effectively has become a strategic imperative. From initial purchase requisition to final payment, each step in the P2P process presents opportunities for improvement, whether through automation, enhanced data visibility, or better collaboration between departments.

This article dives into actionable strategies for optimizing your procure-to-pay processes, helping you drive greater efficiency, reduce errors, and achieve significant cost savings.

What is the Procure-to-Pay Process?

The procure-to-pay (P2P) process is a critical component of every organization’s operations, linking procurement and financial management. It’s more than purchasing items or making payments. This includes all aspects from when a good or service is requested to when the organization pays for it.

The P2P process focuses on the procurement of products and services. It starts with the very first procure request and ends with the payment. This process includes several steps: requisitioning, ordering, receiving, invoicing, and payment.

The P2P process is one element of a broader system known as Source-to-Pay (S2P), which encompasses Source-to-Contract (S2C) activities as well. S2C goes beyond sourcing suppliers, onboarding them, and negotiating contracts. The P2P process, sometimes referred to as a three-way match, serves to identify such errors early in the process.

That involves matching the purchase order, the receiving report, and the invoice to ensure they all align. The procure-to-pay (P2P) process can be completed by hand or through automation. Through automation, the entire process becomes more efficient, faster, and streamlined while minimizing errors.

With software that can digitize invoices and automatically match them to purchase orders, the time savings are significant. It’s more efficient and further minimizes paying the wrong amount. Automation gives businesses increased visibility and transparency into procurement activities, allowing them to make more informed decisions.

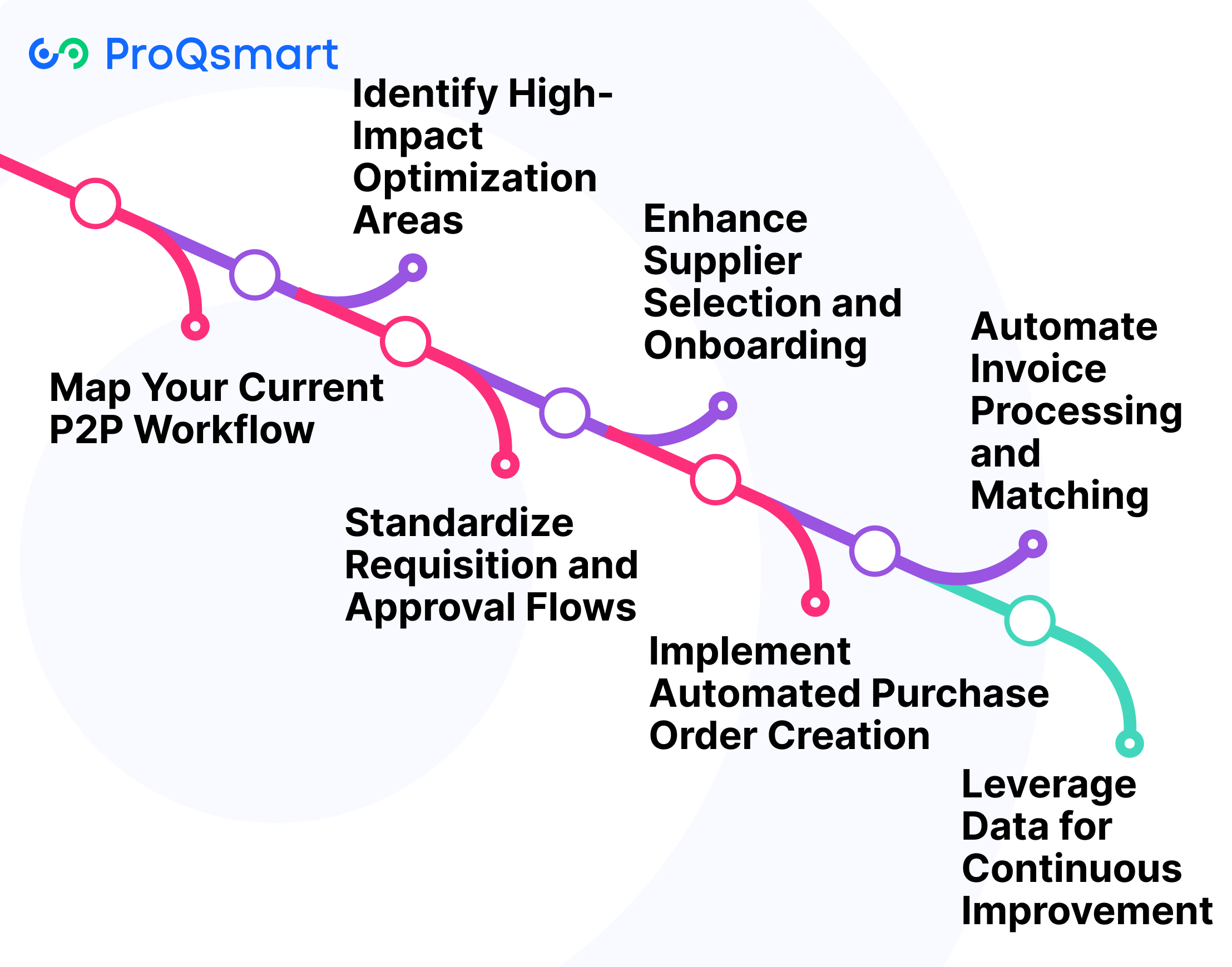

Key Steps to Optimize Your P2P

Optimizing the procure-to-pay (P2P) process is critical for any business looking to increase operational efficiency, reduce costs, and maintain compliance. Creating a strategic approach to optimizing your P2P begins with understanding existing workflows.

Then it’s about focusing on optimization opportunities, creating standardized processes, improving supplier collaboration, and using technology to your advantage. Continuous improvement, driven by data analysis, is key to achieving long-term success in P2P optimization.

1. Map Your Current P2P Workflow

Mapping your current P2P workflow is a crucial first step toward pinpointing bottlenecks and inefficiencies. This means using a flowchart to graphically illustrate each step of your process, starting with purchase requisition and ending with invoice payment.

Tools such as ProQsmart can be useful to visualize the entire P2P process. Engaging stakeholders across multiple departments is key. Involving all pertinent teams from procurement, finance, and operations is critical to developing a complete and accurate map.

Their insights will help you uncover challenges you never knew existed and opportunities to improve. Your procurement team may be the first to identify bottlenecks in the vendor selection process. In return, your finance team could flag issues when invoice processing begins to back up.

This cross-departmental, collaborative approach will help to create the most accurate picture of your organization’s current P2P process so you can see what’s really happening. Creating a process map gives you a great foundation for your optimization efforts by showing you where the biggest opportunities for improvement lie.

2. Identify High-Impact Optimization Areas

Once you’ve mapped the P2P workflow, jump headfirst into an analysis. This step will enable you to identify the areas with the highest potential for impact. This means identifying bottlenecks, inefficiencies, and high-cost activities.

If you’re wasting hours of time routing invoices, look at how to automate the process. Not doing so can cost you thousands of dollars and decrease your operational efficiency. It’s important to prioritize your optimization efforts by the greatest potential cost savings, efficiency gains, and strategic goal alignment.

Make sure the areas selected to optimize are the ones that will make the biggest impact on the organization’s bottom line and performance. Data analysis is invaluable in identifying these high-impact areas. For example, tracking the time it takes to complete a purchase order or process an invoice can reveal areas where improvements are needed.

3. Standardize Requisition and Approval Flows

Establishing standardized purchase requisition and approval workflows can help minimize errors, streamline the purchase process, and enhance compliance. This means establishing standardized, easy-to-understand procurement policies and procedures that clearly lay out the process for submitting, reviewing, and approving purchase requests.

These policies should specify the information required for each requisition, the approval levels needed, and the timelines for processing requests. By uniformly applying these policies, you can guarantee that all purchases are made in a consistent and managed way.

4. Enhance Supplier Selection and Onboarding

Enhancing supplier selection and onboarding is crucial to any business, and having a reliable supply chain is key to any procurement strategy. This means finding and vetting the best suppliers, judging them by factors like quality, cost, delivery history, and financial viability.

Negotiating favorable payment terms with your suppliers, i.e., paying on a longer payment schedule, can mean tremendous savings. For instance, obtaining early payment discounts or extended payment terms can help achieve positive cash flow and lower total procurement costs.

Robust onboarding helps you establish the right foundational supplier relationships. It sets clear expectations, opens lines of communication, and trains the supplier on the organization’s procurement procedures.

ProQsmart, a collaborative procurement platform, enables organizations to create smart decisions and more efficient supplier relationships. Using the platform makes bidding easier as it offers features such as E-tenders.

5. Implement Automated Purchase Order Creation

Not only does automating purchase order creation save incredible amounts of time, but it reduces the risk of human error. We automate the creation of purchase orders from purchase requisition data. This means we can create purchase orders automatically from approved requisitions.

Preventing data inaccuracy is crucial. Often, data inconsistencies occur when purchase orders are created independently outside the P2P process. You can prevent mistakes from happening in the first place by setting up data validation rules.

Automated checks will flag for review key information such as supplier information, description of item, and pricing. Automation reduces the need for manual work by a large margin. It reduces errors by eliminating time-consuming, error-prone manual data entry that is prone to human error.

6. Automate Invoice Processing and Matching

Additionally, automated invoice processing and invoice matching speeds up the accounts payable process and shortens processing time. We harness the power of optical character recognition (OCR) and artificial intelligence (AI) to extract invoice data.

Next, we use automation to match this data against POs and goods receipts. With automation, you can reach more than 99% accuracy, minimizing discrepancies and speeding up approvals. Automating the three-way matching process—purchase orders, goods receipts, invoices—expedites payment and increases efficiency.

This ensures you only pay for the goods or services you’ve actually received. This significantly reduces the risk of fraud or errors occurring and increases confidence that the organization is paying the right amount. Automation helps avoid keying errors and speeds processing time by removing the requirement for manual data entry and matching.

7. Leverage Data for Continuous Improvement

Measuring P2P performance through data will help determine the areas that need to be improved and allow for constant optimization. This includes measuring and analyzing key performance indicators (KPIs) like invoice processing time, cost per transaction, supplier performance, and more.

When you report on and analyze these KPIs consistently, it uncovers trends and patterns. These learnings point to where we have room for improvement. If your processing time for invoices is always high, address it.

This can be a sign that the invoice approval process needs to be expedited. Leveraging data-driven insights offers transparency into the overall health and performance of your P2P. They focus on where the most effective change can be made, allowing for ongoing improvements and optimization.

Unlock Benefits with P2P Automation

Procure-to-pay (P2P) automation brings tremendous benefits to organizations looking to improve procurement efficiency and effectiveness. By automating tasks like invoice processing, vendor selection, and payment management, organizations can achieve increased efficiency, enhanced visibility, and substantial cost savings.

By strategically automating the P2P process, you’re empowered to make more informed decisions, build stronger relationships with suppliers, and drive overall business success.

Boost Overall Process Efficiency

P2P automation makes the entire process more efficient by eliminating unnecessary manual effort and speeding up the overall process. For example, automating invoice processing can reduce processing time by 65%, saving you a considerable amount of money.

With ProQsmart, businesses are able to automate workflows, resulting in a shorter cycle time with quicker invoice processing. This increased efficiency reduces operational costs, while making employees more productive and happy.

Gain Real-Time Financial Visibility

With automated P2P processes, they have real-time visibility into financial data, such as spending patterns and cash flow. With accurate, real-time financial information at your fingertips, you can make more informed decisions, manage your budget more effectively, and gain greater control over costs.

Better cash flow management is another benefit. P2P automation enhances cash flow management by automating payment processing and scheduling. This provides organizations with a real-time, comprehensive, and accurate picture of their financial condition.

Strengthen Supplier Relationships

P2P automation helps to build strong relationships with suppliers through faster, easier communication and payment. Automating supplier communications with self-service portals for suppliers and real-time updates on payment status ensures transparency and builds trust.

Suppliers are more likely to grant better pricing, quality, and service when fair and timely payments are prioritized—strengthening supplier relationships.

Improve Compliance and Reduce Risk

P2P automation helps mitigate non-compliance with procurement policies and regulations by facilitating the provision of automated audit trails and fraud detection. Data security and privacy are at the heart of the P2P process, and automation reduces the risk of non-compliance.

Better compliance minimizes the chances of incurring fines, penalties, or reputational harm, protecting the integrity of the business. With ProQsmart, compliance is no longer an issue with smart, precise, and auditable sourced data.

Leverage Technology for P2P Success

Shifting from traditional to transformative To truly optimize the procure-to-pay (P2P) process, Vishal recognizes that technology is more than a good-to-have — it’s a must-have. By leveraging the right technologies, procurement can reduce rework, automate repetitive tasks, reduce errors and increase operational efficiency.

By deploying P2P automation systems, organizations can establish automated, seamless workflows and improved visibility from end-to-end. Technology allows for easy real-time sharing of data, streamlining procurement to address the most urgent needs. Having a tech-savvy mind will help make P2P long-term sustainable.

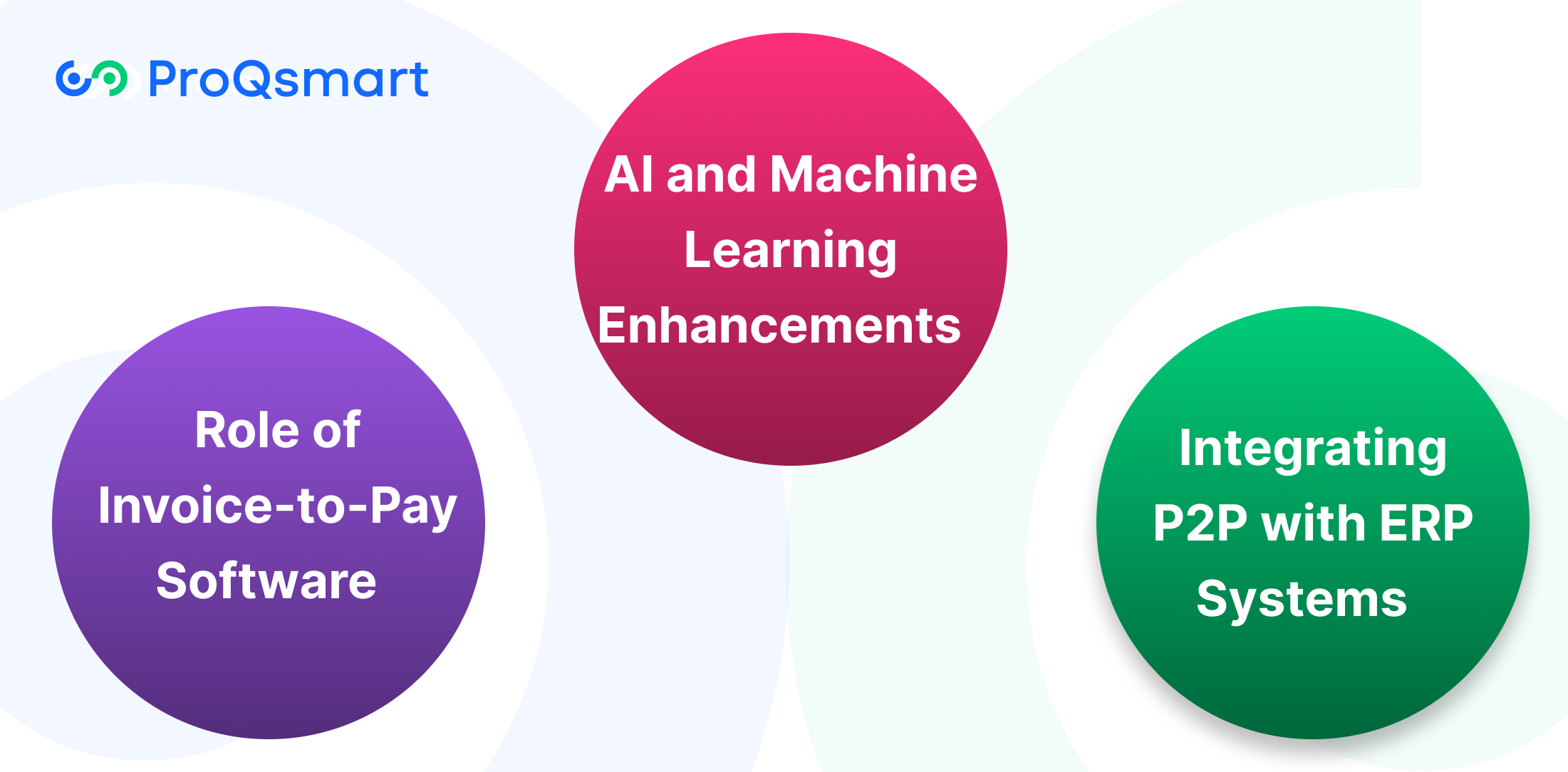

Role of Invoice-to-Pay Software

Invoice-to-pay software automates the entire processing, matching, and payment of invoices. Features you should consider are OCR, full workflow automation and comprehensive reporting capabilities.

Using invoice-to-pay software reduces manual work, which increases efficiency, accuracy, and compliance. By automating invoice capture and validation, you’ll make three-way matching of the PO, receipt and invoice more seamless to avoid discrepancies.

AI and Machine Learning Enhancements

AI and machine learning advancements AI and machine learning are further improving P2P by automating tedious tasks, increasing accuracy, and providing better insights. AI can help automate invoice data extraction, fraud detection, and spend analysis.

What these tools do is save an immense amount of manual work and help make better decisions. Take ProQsmart—an AI-driven procurement platform that empowers businesses to leverage artificial intelligence to drive better decisions and smarter procurement processes.

It provides capabilities such as E-tenders, SRM, collaborative tools, and compliance monitoring. Finally, AI and machine learning allow for ongoing refinement.

Integrating P2P with ERP Systems

Integrating P2P software with enterprise resource planning (ERP) systems ensures a seamless flow of data and removal of data silos. By integrating P2P with an organization’s ERP systems, you receive deep end-to-end visibility and control.

Most importantly, it helps to drive efficiency, accuracy, and better-informed decision-making. Businesses typically see labor cost savings between 15% and 20% with P2P automation.

Adopt Procure-to-Pay Best Practices

The procure-to-pay (P2P) process is important to drive efficiency, cost savings, and operational success. In order to realize the greatest results, organizations need to embrace procure-to-pay (P2P) best practices.

Adopting these best practices will result in more informed decision-making, stronger supplier relationships, and increased agility in today’s rapidly changing business environment. Making continuous improvement a priority will go a long way toward keeping your P2P process best-in-class and agile enough to respond to ever-changing market conditions.

These traditional one-size-fits-all approaches are often out of step with complex, unique enterprise procurement processes.

Focus on Strategic Sourcing First

Strategic sourcing is the linchpin of a successful P2P process. It means doing the research to find and choose the best suppliers—not just for cost, but for quality and reliability.

Negotiating favorable contracts and payment terms is only half the battle. Once implemented, strategic sourcing can produce significant cost savings, better quality materials and products, and enhanced supplier relationships.

Consider ProQsmart for instance. Fueled by generative AI, this innovative procurement platform enables organizations to take more intentional actions and maximize the value of their procurement operations.

Real-time collaboration. Simplified bidding with E-tenders. Strengthening supplier relationships. ProQsmart provides numerous features to help foster collaboration and promote innovation.

Prioritize Robust Supplier Management

Proper and robust supplier management can help ensure a robust supply chain. This means tracking supplier performance and being proactive with any concerns.

This means building strong, collaborative relationships with a few key suppliers. With proper supplier management, risk is minimized and performance is maximized.

Utilize Three-Way Matching Effectively

Three-way matching (purchase order, goods receipt, invoice) and other built-in checks help detect errors and fraud. Automating this process with procure-to-pay technology ensures accurate and timely payments.

When done correctly, three-way matching increases accuracy and compliance.

Monitor Key Performance Indicators (KPIs)

Monitoring KPIs tracks P2P performance and identifies areas for improvement. Examples of common KPIs to monitor are average time to process an invoice, average cost per transaction, supplier performance, etc.

Frequent reporting and analysis keep you informed with data-driven insights for ongoing optimization and improvement.

Conclusion

By optimizing your Procure-to-Pay (P2P) processes, your organization can achieve significant gains in efficiency, cost savings, and overall financial control. Streamlining these processes, from initial purchase requisition to final payment, reduces errors, improves transparency, and fosters stronger supplier relationships. A well-optimized P2P system ensures that you’re getting the best value for every dollar spent while maintaining compliance and minimizing risks.

Ready to take your Procure-to-Pay process to the next level? Schedule a demo with ProQsmarttoday and discover how our platform can help you automate tasks, gain real-time visibility, and drive measurable improvements in your bottom line.