Effective financial forecasting is crucial for procurement teams to make informed decisions, manage risks, and drive cost savings. By leveraging historical data, market trends, and economic indicators, organizations can anticipate future financial performance and align their procurement strategies accordingly. This proactive approach enables better budget planning, resource allocation, and strategic goal setting.

In procurement, good forecasting underpins smart strategic planning, supports the case for necessary investments, and enhances long-term financial health. Advanced tools and software can significantly improve the accuracy and speed of forecasting, allowing businesses to navigate uncertainties and align operations with long-term objectives. Whether managing a small business or a large corporation, integrating financial forecasting into procurement processes is essential for achieving sustainable growth and efficiency.

Let’s explore the step-by-step approach to integrating financial forecasting into procurement processes, highlighting its methods, applications, and benefits.

Understanding Financial Forecasting

1. What is Financial Forecasting?

Financial forecasting is the process of using an organization’s past financial performance and prevailing industry conditions to estimate future results. The importance of making things clear Absolute accuracy can never be the aim. Instead, we help them establish an accurate and predictable framework to forecast revenue, expenses and cash flow.

For instance, with financial forecasting, a manufacturing business could look at historical sales trends and current market demand to project future production requirements. Although forecasts are impacted by variables that continuously change, they are still critical in steering organizations, local and regional governments to make the best-informed decisions.

Essentially, forecasting is about what could be, and budgeting is about turning that into what will be still leaving room for flexibility.

2. Forecasting vs. Budgeting

Forecasting predicts future financial scenarios, while budgeting allocates resources to achieve financial goals. By aligning the financial forecasting process with budgeting, businesses can ensure resources are directed effectively, reducing risks and costs while enhancing financial management.

|

Feature |

Forecasting |

Budgeting |

|---|---|---|

|

Purpose |

Guide decision-making by predicting future financial conditions. |

Manage expenses, allocate resources, and assess performance against set targets. |

|

Time Frame |

Can cover one to five years with regular updates. Both short-term and long-term. |

Typically covers a fixed period, usually one fiscal year. Short-term. |

|

Level of Detail |

Less detailed, provides broader estimates of revenue, expenses, and cash flow. |

More detailed and precise, breaking down revenues, costs, and resources. |

|

Approach |

Analyzes past performance and current trends, incorporating various factors that may affect future outcomes. |

Sets financial goals and objectives based on various assumptions and scenarios. |

|

Variance Analysis |

Not typically involved; compares forecasts with actual results to assess accuracy. |

Involves comparing actual results with budgeted targets to identify gaps and opportunities. |

|

Nature |

Dynamic. |

Static. |

3. Importance of Financial Forecasting in Procurement

In procurement, financial forecasting supports stable cash flow and enables informed spending decisions. Accurate forecasts allow organizations to evaluate risks, optimize costs, and plan for sustainable growth.

For instance, procurement teams can use forecasting to anticipate price fluctuations in raw materials, ensuring cost-effective purchasing strategies. This proactive approach minimizes financial uncertainties and enhances overall performance.

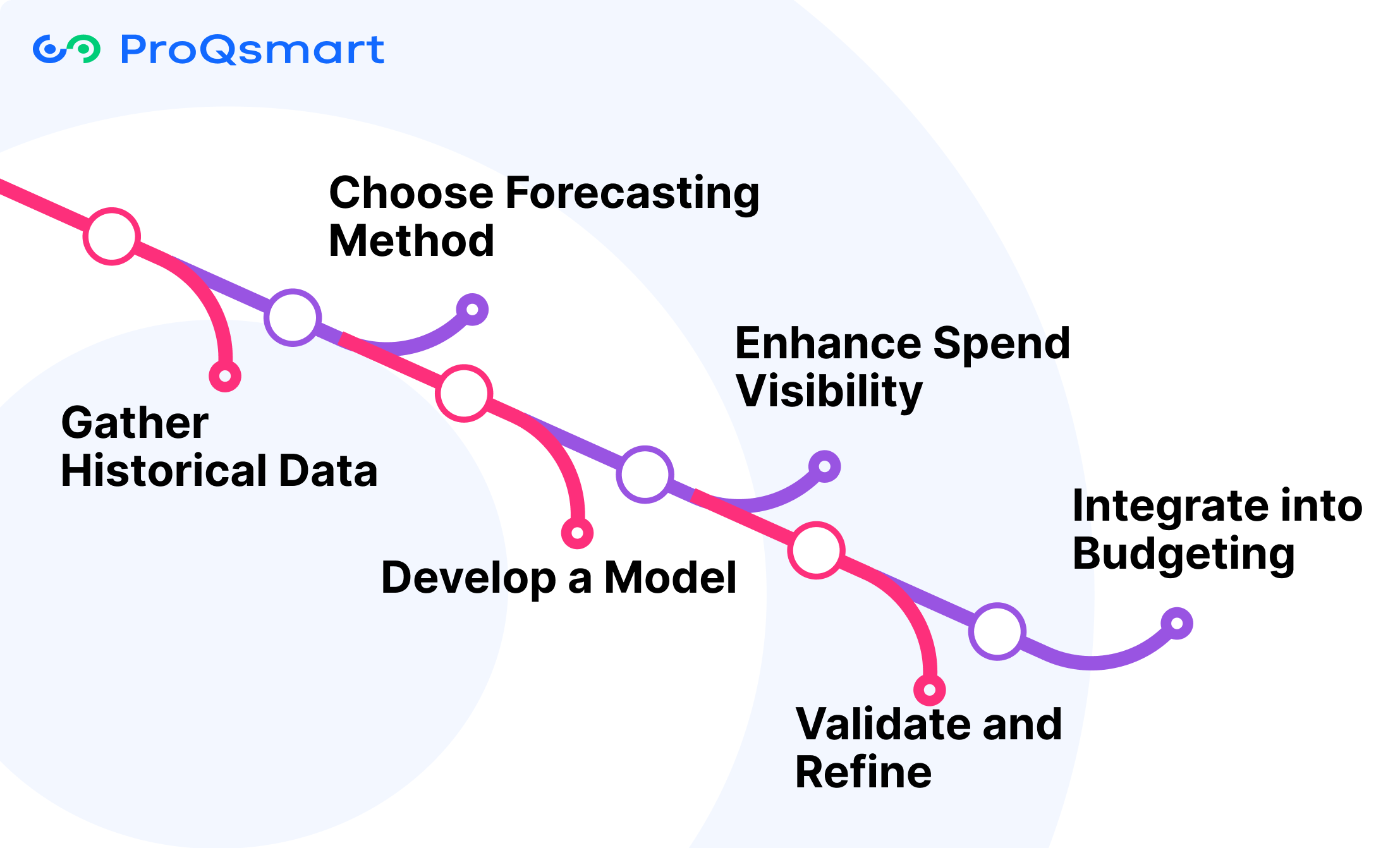

How to Integrate Forecasting into Procurement

Integrating the financial forecasting process into procurement offers a structured approach to predict spending, improve decision-making, and align procurement strategies with business goals. By utilizing financial forecasting tools, you can connect procurement easily to budgeting and financial planning through historical data and smart forecasting methodologies.

Step 1: Gather Historical Data

To create a good forecast, you first need historical data. Procurement teams can also use past procurement spending patterns, which can easily be categorized by supplier or product. They include considerations like contract length, renewal windows, market developments, and internal considerations, like growth strategies or new product introductions.

Data sources like ERP systems, procurement software, and accounting records can help centralize this information and make it easy to access. As an example, vendor contracts and purchase orders usually contain key spending information.

Besides, by analyzing this data, we can start to understand patterns and what variables affect procurement that can form a consistent baseline for forecasting.

Step 2: Choose Forecasting Method

Choosing the most appropriate forecasting technique will often be a question of complexity versus data availability. Whereas traditional budgets deliver a level of stability that can be comforting, rolling forecasts prioritize flexibility and adaptability.

Weighing their benefits and drawbacks gives you the most informed choices. Though classic budgets are annual plans with clearly defined limits, rolling forecasts can correspondingly be more fluid, able to realign with market changes and procurement direction.

Step 3: Develop a Model

Creating a financial forecasting process requires you to use a variety of statistical tools and predictive analytics against your financial data. Procurement software like ProQsmart improves forecasting accuracy by leveraging AI-driven insights, automating workflows, and centralizing all procurement processes.

Step 4: Enhance Spend Visibility

With ProQsmart, the financial forecasting process is simplified by centralizing all procurement data and automating real-time spend reporting. This eventually enhances visibility and provides critical insights into spending trends, supplier performance, and compliance metrics, influencing future business performance.

Step 5: Validate and Refine

To ensure accuracy in the financial forecasting process, validation involves continuously monitoring your financial forecasts and making adjustments as necessary. Regularly updating these forecasts with real-time financial data enhances their reliability.

Step 6: Integrate into Budgeting

Besides, by integrating financial forecasts into the budgeting process, organizations align operational plans with strategic goals, enhancing both precision and flexibility beyond standard budgeting approaches.

Benefits of Integration

Integrating financial forecasting with procurement processes provides significant benefits that touch the heart of operational efficiency and strategic growth. Besides, by embedding forecasting tools and insights into procurement workflows, organizations can better align their financial and operational goals, creating a seamless connection across departments.

With this integration, regional leaders make more informed decisions, deploy resources more effectively, and foster sustainable long-term growth.

Budget Accuracy

Improved financial forecasting leads to more accurate budget planning and resource allocation, thereby avoiding potential overspending or insufficient resources. Key considerations, such as robust data gathering and frequent recalibration, enhance the effectiveness of the financial forecasting process. A shared understanding of forecasting goals is essential for achieving precise financial outcomes.

With real-time expense tracking, ProQsmart significantly simplifies the cash flow forecasting process for users. By unifying fragmented procurement data into a centralized platform, it ensures easy access to critical financial data.

Integrating sales forecasting methodologies allows companies to align their purchasing with real-time needs. This approach generates an integrated metric of financial health that encompasses the income statement, balance sheet, and cash flow statements.

Cost Reduction

Proactive financial forecasting helps procurement to spot cost-saving opportunities earlier, by considering the historical spend, supply market trends, and other relevant factors. A platform like ProQsmart enables real-time spending visibility, optimizing sourcing strategies and supplier negotiations.

Additionally, automated workflows and e-tendering processes eliminate time wasted on unnecessary tangential operations, driving inefficiencies into operations and inflating costs.

Efficiency and Productivity

By automating manual procurement tasks, more accurate forecasts allow organizations to better match purchases with demand. ProQsmart supports better collaboration through a shared data foundation, so all stakeholders are working off the same, up-to-date information.

For example, traditional approaches are heavily dependent on siloed data whereas ProQsmart pulls information into one place providing better productivity.

Risk Management and Strategic Decisions

Forecasting helps foresee potential risks such as liquidity bottlenecks and develop risk mitigation strategies including diversifying suppliers and securing alternative financing sources.

It facilitates scenario planning from best-case to worst-case, mobilizing more informed, adaptive decision-making.

Latest Forecasting Methods

Accurate financial forecasting ultimately creates the foundation for any successful business plan, and provides a peek into your future revenue, expenses, and investment return. Choosing the most appropriate forecasting method has a lot to do with the kind and complexity of data at hand.

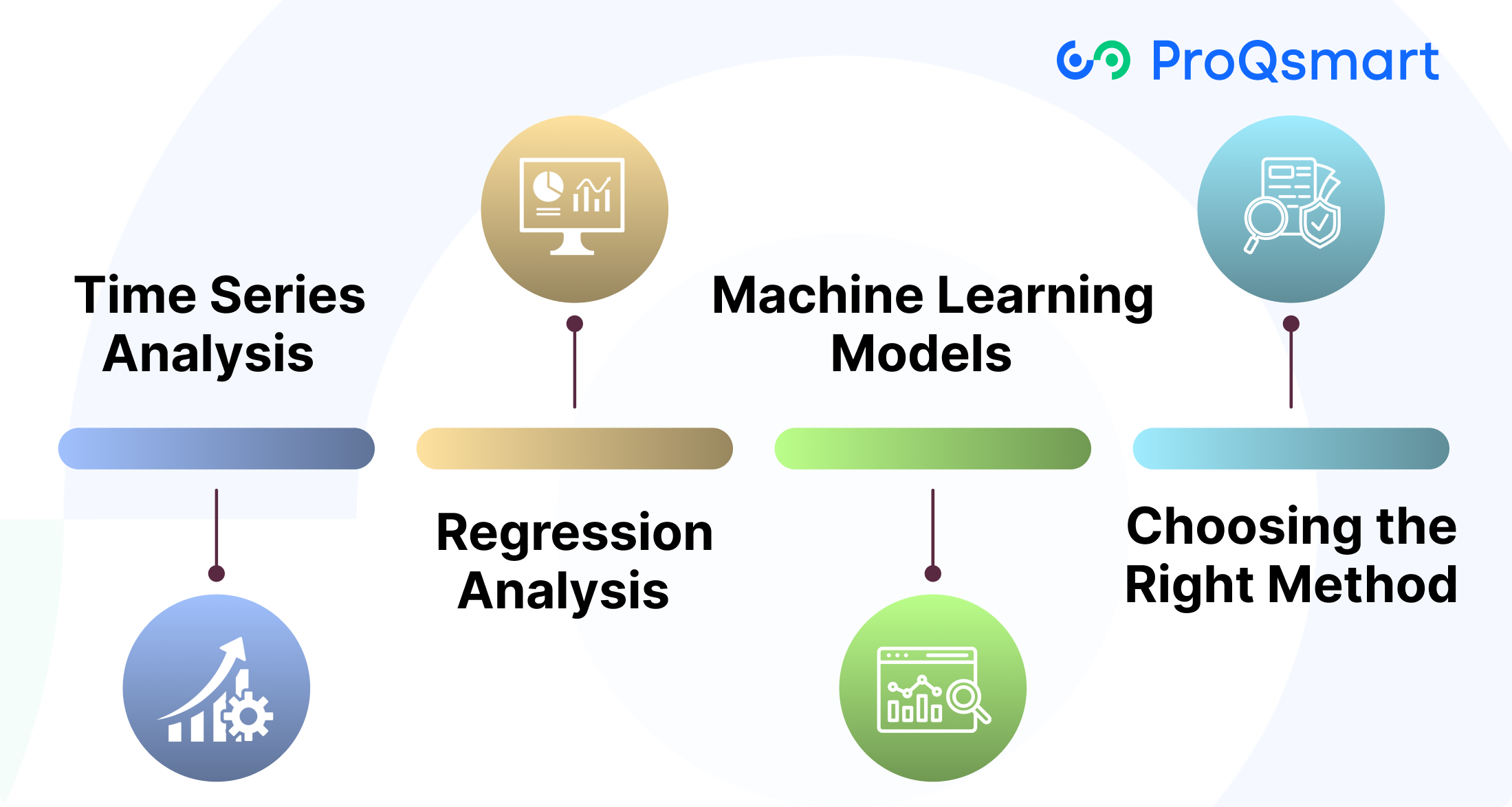

Time Series Analysis

Time series analysis focuses on historical data patterns to predict future trends. Among the most popular techniques in this category are 3-month and 5-month moving averages, which smooth out fluctuations to highlight underlying trends.

A 5-month moving average shows seasonal patterns in sales. This knowledge allows retailers to more accurately predict how to fill their inventory.

Straight-line forecasting, another time series method, assumes constant growth over a period, making it suitable for stable industries with predictable performance.

Regression Analysis

Regression analysis is a statistical approach to estimating relationships among variables in order to predict future results. Simple linear regression considers one independent variable, such as marketing spend, and its impact on a dependent variable like sales.

This approach is perfect for companies that want to tie concrete activities to monetary outcomes. Multiple linear regression takes it a step further by adding in multiple independent variables.

That’s because it considers consumer acceptance, pricing strategies and advertising into the mix. This multi-faceted approach offers a comprehensive, layered view of financial performance.

Machine Learning Models

The entry of machine learning into the forecasting space has drastically changed the game, especially when tackling massive datasets. Financial forecasting software tools help save companies time by centralizing data from multiple finance areas into one system, making it easier to access accurate data.

Whereas, widely used algorithms, like neural networks and decision trees, continuously learn from data patterns as they change over time, increasing predictive accuracy.

Choosing the Right Method

Correspondingly choosing the right financial forecasting tools comes down to data usage, complexity, and your organization’s priorities. When creating simple financial forecasts, time series methods are efficient, but regression or machine learning is better for more complex forecasting scenarios.

AI’s Role in Financial Forecasting: ProQsmart

Artificial intelligence is revolutionizing the financial forecasting process, providing procurement professionals with sophisticated financial forecasting tools to enhance accuracy and efficiency. ProQsmart leverages AI to tackle complex forecasting revenue challenges, identifying key patterns in financial data to deliver actionable insights that align with evolving procurement demands.

Automated Data Analysis

ProQsmart applies the very latest automated data analysis tools to classify spend data with 97% accuracy. This new technology allows a granular, detailed and transparent accounting of spending. These tools increase efficiency by speeding up the production of financial statements and the monthly close process.

In one instance for example, ProQsmart eliminates manual data entry, saving hours that were once spent reconciling budgets. The outcome is accelerated and more accurate financial forecasting. Besides, by fully embedding procurement teams into a data analytics function, as 22% of top-performing organizations have, organizations can better position themselves to leverage data-driven strategies.

Predictive Analytics

Predictive analytics leverages statistical algorithms and machine learning to predict future procurement results. ProQsmart is a leader in this field, providing solutions to forecast market demand, analyze inventory levels, and measure supplier scorecards.

For example, when AI decreases forecast errors by 30%, companies can have more confidence controlling budgets and managing risks. This method reduces instances of stockouts or overspending and even helps to build relationships with suppliers. Tools like ProQsmart streamline adoption by providing intuitive dashboards that analyze historical trends and market conditions, ensuring operational efficiency and informed decisions.

Improved Accuracy

Accurate forecasts are essential for ensuring budgetary compliance, directing resources effectively, and enabling strategic long-term infrastructure planning. By analyzing historical and market intelligence data, ProQsmart increases accuracy, while mitigating the risk of overspending or strained supplier relationships.

Additionally, advanced forecasting tools facilitate transparency, helping shape procurement strategies around organizational goals and priorities. Inaccurate forecasting results in missed savings and operational inefficiencies, yet AI-powered insights empower organizations to overcome these challenges.

Conclusion

Financial forecasting goes beyond the dollar signs. It’s about informing better procurement decisions. With the right tools and methods, you unlock transparency that affords you actionable insights to inform your sourcing strategies, budget forecasting, and risk mitigation scenarios. When you integrate advanced techniques, including AI-driven solutions like ProQsmart, you maximize your accuracy and efficiency. This helps you stay one step ahead in a rapidly evolving marketplace.

With careful implementation of these strategies, you’ll be able to cut costs, creating happier suppliers and a more streamlined business. It’s about needing to do more with less and focusing on processes that do more for you, being nimble but adaptable, future-proofed and smart.

To take your procurement strategy to the next level, consider integrating advanced forecasting techniques with leading procurement software like ProQsmart. ProQsmart offers cutting-edge solutions that enhance forecasting accuracy and efficiency, helping you stay ahead of the competition. Book a demo today to discover how ProQsmart can transform your procurement operations and unlock new opportunities for growth and innovation.