Effective management of both operational vs capital budget is a crucial determinant of an organization’s success in procurement and financial management. The ability to balance these budgets not only ensures financial stability but also supports strategic planning and resource allocation, ultimately driving overall performance and growth. Operational budgets ensure the continuity of day-to-day operations, covering essential expenses that keep the business running smoothly. In contrast, capital budgets empower organizations to make strategic, long-term investments that drive growth, innovation, and competitive advantage.

For procurement professionals, understanding the nuances of these two budget types is not just a financial necessity—it’s a strategic imperative. The decisions made today, whether in managing recurring costs or approving capital expenditures, profoundly the organization’s financial health and future trajectory. This article explores the key differences between operational vs capital budgets, their implications for procurement management, and how leveraging these budgets effectively can lead to smarter financial decisions and stronger business outcomes.

What Are Operational and Capital Budgets?

Operational Budget

An operational budget is a comprehensive financial plan that outlines the ongoing costs necessary for day-to-day business operations over a specific period, typically a fiscal year. This budget focuses on non-discretionary expenses, such as

Salaries

Rent utilities

Other essential operational costs,

ensuring that the organization maintains financial stability and protects against long-term financial risks.

Monitoring these expenses is crucial for effective short-term planning and cash flow management. For instance, a manufacturing facility would incorporate costs such as raw materials and labor expenses into its operational budget. This strategy enhances productivity by aligning immediate operational needs with the organization’s long-term goals, ensuring that resources are allocated effectively to support ongoing projects and overall growth.

Capital Budget

In contrast, a capital budget involves one-time investments in fixed assets that yield benefits over an extended period. These budgets are integral to an organization’s strategic financial planning and future growth initiatives. Examples of capital expenditures include purchasing new machinery or investing in interior fit-out.

Capital budgeting emphasizes the allocation of funds towards fixed assets, focusing on maximizing long-term returns on investment. Without a well-structured capital budget, organizations may struggle to invest effectively in their mission, potentially hindering operational efficiency and long-term growth.

Importance of Understanding Budgets

For procurement professionals, comprehending the distinctions between operational and capital budgets is essential for making informed financial decisions that significantly impact the organization’s bottom line. Budgetary decisions between operational vs capital budget dictate resource allocation and future investment strategies. Regular reviews of both budget types are considered best practices to adapt to changing fiscal realities and ensure that financial resources align with organizational goals.

Effective budgeting facilitates the achievement of immediate operational efficiency while supporting long-term strategic objectives.

Characteristics of Operational Budgets

Operational budgets primarily address day-to-day expenses, which are critical for maintaining smooth business operations. Key characteristics include:

Focus on Ongoing Expenses: Major components include employee wages, rent, and utilities. These recurring costs are significant drivers of the overall health of the budget; thus, diligent tracking is necessary to prevent overspending.

Short-Term Financial Planning: Operational budgeting is inherently short-term in nature, requiring accurate estimates of upcoming expenditures to meet cash flow needs effectively. Flexibility is vital as organizations must adapt their plans in response to unforeseen challenges.

Recurring Costs Management: Effective management strategies involve analyzing past spending patterns to inform future budgets and implementing cost control measures. Regular assessments can uncover potential savings opportunities, enhancing overall budget efficiency.

Characteristics of Capital Budgets

Capital budgets focus on long-term investments that support an organization’s infrastructure and economic stability. Their key characteristics include:

Focus on Long-Term Investments: These budgets provide a framework for evaluating potential returns on investment for capital projects, emphasizing their importance in sustaining corporate growth.

Asset Acquisition Planning: Necessary acquisitions should align with business goals and strategies. This involves conducting thorough cost-benefit analyses and considering financing options to ensure optimal asset stewardship.

Strategic Financial Planning: Engaging stakeholders in the capital budgeting process enhances decision-making effectiveness. Financial forecasting plays a critical role in aligning capital expenditures with evolving organizational priorities.

By understanding between operational vs capital budget, organizations can strategically allocate resources to enhance operational efficiency while fostering long-term growth and sustainability.

Differences Between Operational and Capital Budgets

These two types of budgets are distinct in purpose and are designed to control different aspects of an organization’s finances.

Let’s unpack the major differences of operational vs capital budget

Aspect | Operational Budget | Capital Budget |

Time Frame and Duration | Short-term (monthly, quarterly, or annual). | Long-term (multi-year investments). |

Types of Expenses Covered | Recurring, day-to-day expenses (e.g., salaries, utilities, office supplies). | One-time or infrequent, high-value investments (e.g., machinery, technology, infrastructure). |

Impact on Cash Flow | Directly affects monthly cash flow. | Requires significant upfront investment but generates long-term returns. |

Financial Plan Influence | Focuses on maintaining current operations. | Focuses on future growth and strategic goals. |

Approval Process | Typically approved as part of routine financial planning. | Requires rigorous justification and approval due to high costs and long-term impact. |

Recording in Financial Statements | Recorded as expenses on the income statement. | Recorded as assets on the balance sheet and depreciated over time. |

Examples | Monthly utility bills, office supplies, employee salaries. | Purchasing new machinery, building a new facility, implementing an ERP system. |

How Budgeting Plays a Role in Procurement Management

Procurement Strategy Development

Operational budgets serve the immediate needs of the organizational periphery, such as office supplies or elevator maintenance contracts, delivering guidance for transactional, routine purchasing choices. This helps make sure that everyday operational needs are covered with maximum efficiency.

We can use our capital budgets, which are intended for big ticket investments such as big machinery and infrastructure replacement/upgrade. These projects require a long-term vision to plan and implement. By understanding the difference between operational vs capital budget, savvy procurement professionals can pivot spend toward organizational priorities and drive more strategic sourcing decisions.

A capital budget allows a construction company to invest in new cranes. It allows them to use their operational budget to buy safety gear, stretching limited resources further to cover a wide variety of needs.

Vendor Selection Criteria

Vendor selection is another aspect of procurement management where awareness of the bottom line is crucial. Additionally, when vendors are being selected, procurement managers need to consider if a vendor’s offerings fit with the operational budget or capital budget. This means evaluating cost, quality, and delivery lead times.

For example, a manufacturing company may select a supplier who can offer a cheaper maintenance service to keep within their operating budget. At the same time, they’ll search for a competing vendor to provide that same high-value capital equipment. Organizations further align vendors with certain types of budgets.

This helps them compromise to strict financial constraints while still maintaining high quality standards of suppliers. This alignment not only creates a positive supplier relationship, it helps mitigate procurement risk and maximizes value.

Contract Management Implications

Budgeting extends beyond the procure to contract management, foreshadowing what is included in the terms and conditions in agreements. Contracts linked to operational budget lines typically have shorter terms and more flexible terms to allow for the fluidity of purchasing that can happen more often.

Capital budget contracts, for example, can have much longer dates with very specific specifications for the more significant investment. Just like a construction company investing in new machinery would negotiate comprehensive service agreements to safeguard its capital investment, manufacturers must also ensure that their significant expenditures are protected through detailed contracts and warranties. This approach not only secures the functionality and longevity of the equipment but also mitigates risks associated with maintenance and operational downtime.

Further, operational contracts would fund regular software upgrades, which are critical to maintaining and improving functionality. Strategic contract management, in accordance with budgetary goals, protects against noncompliance and optimizes ROI.

Strategies for Effective Budgeting in Procurement

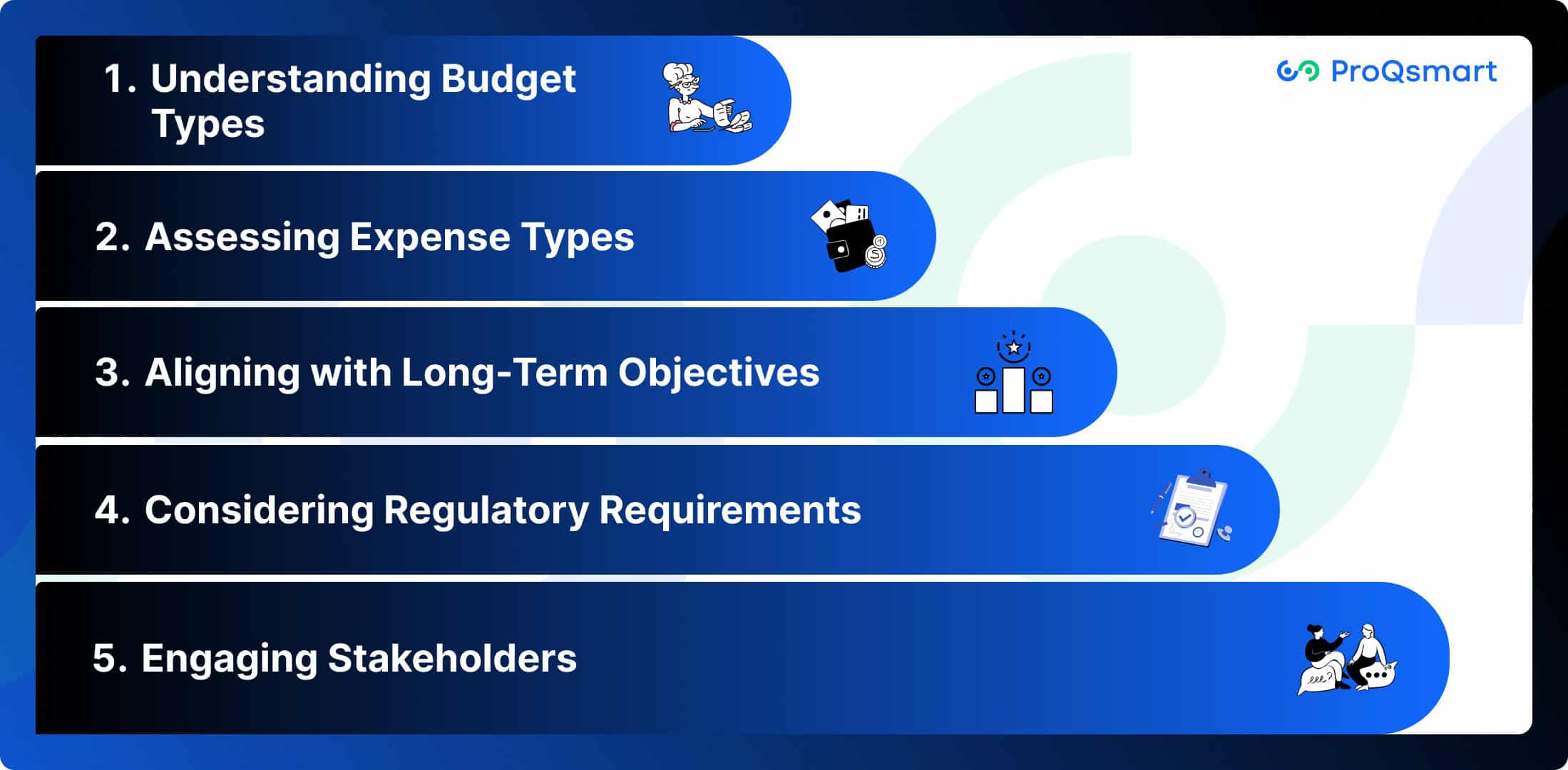

Understanding Budget Types

Choosing the right budget is essential for effective procurement planning. Both operational and capital budgets serve distinct purposes and come with their own advantages and challenges.

Assessing Expense Types

One of the primary considerations when selecting between operational vs capital budget is the type of expenses your organization will incur. These expenses are essential for maintaining smooth operations and ensuring that the workforce is adequately supported. On the other hand, capital budgets are reserved for larger investments, such as purchasing new equipment or making facility improvements. Understanding the nature of your business can guide your budgeting approach. For industries that frequently require updates or upgrades to technology and machinery, a capital budget is essential to accommodate these significant expenditures.

This approach allows businesses to strategically plan for large investments that enhance operational efficiency and competitiveness.

In contrast, companies with stable operational costs throughout the year may find that an operational budget suffices, enabling them to manage day-to-day expenses effectively without the complexities associated with larger capital investments.By understanding the distinct needs of their operations, organizations can tailor their budgeting strategies to ensure optimal resource allocation, compliance with financial regulations, and support for long-term growth initiatives. This strategic approach not only facilitates smoother budgeting processes but also positions businesses for sustained success in a dynamic market environment.

Aligning with Long-Term Objectives

Long-term objectives are another critical factor in budgeting decisions. Organizations must consider their strategic vision when determining which budget type to prioritize. If your focus is on maintaining stability and profitability in the short term—perhaps due to fluctuating market conditions—an operational budget may be appropriate to manage immediate expenses effectively. However, if you have ambitious growth plans that necessitate significant investments in infrastructure or technology, a capital budget could better align with those goals by providing the necessary resources for expansion and innovation.

Considering Regulatory Requirements

In addition to internal considerations, it’s important to factor in any regulatory requirements that may influence your budgeting strategy. Certain industries are governed by specific guidelines regarding how funds can be allocated or spent, which can impact whether an operating or capital budget is more feasible. For instance, manufacturing organizations often operate under stringent regulations regarding capital expenditures, which require meticulous planning and justification of budget requests. Understanding these regulations is crucial for ensuring compliance and can lead to more efficient budgeting processes. By aligning budget proposals with regulatory requirements, manufacturers can streamline approval workflows and reduce the risk of delays or rejections. This proactive approach not only facilitates smoother budgeting but also helps in optimizing resource allocation and enhancing overall operational efficiency.

Engaging Stakeholders

Engaging key stakeholders within your organization is vital when making budgeting decisions. Collaboration with department heads, financial experts, and other relevant personnel can provide valuable insights into which budget type aligns best with your strategic objectives. Stakeholder input can also help identify potential challenges and opportunities that may not be immediately apparent, leading to a more comprehensive budgeting process. By fostering open communication and collaboration, organizations can create a more robust budgeting framework that supports both current needs and future aspirations.

Future Trends in Operational and Capital Budgeting

Technological Integration

Technology is fundamentally transforming how organizations approach budgeting and procurement. The integration of artificial intelligence (AI) and automation is revolutionizing capital planning processes, enabling companies to enhance efficiency and minimize errors.

To simplify the complexities of capital expenditure (CapEx) management, consider leveraging ProQsmart. ProQsmart can significantly streamline budget management by automating workflows and enhancing document handling through electronic tenders. This automation reduces the administrative burden on procurement teams, allowing them to focus on strategic financial planning and resource allocation. With ProQsmart’s real-time tracking capabilities, organizations can monitor expenditures against budgets as they occur, ensuring financial control and preventing overspending. The platform also offers customizable budget templates and integrated financial planning tools, which facilitate accurate and efficient budget creation. By providing detailed insights and analytics, ProQsmart empowers decision-makers to make informed choices that optimize capital expenditures and improve overall financial performance.

Data-Driven Decision Making

The importance of data in shaping strategic budgeting and procurement strategies is paramount. By leveraging data analytics, organizations can extract meaningful insights from historical spending, anticipate future trends, and allocate budgets more effectively. ProQsmart stands out in this regard, providing users with advanced AI tools to create customizable dashboards and detailed reports.

These features enable procurement teams to make informed decisions based on reliable data. Organizations can evaluate supplier performance continuously and ensure compliance with contract terms, ultimately enhancing operational efficiency.

Moreover, data analytics transforms raw information into actionable insights, facilitating agile decision-making. This capability allows organizations to respond swiftly to changing market conditions and optimize their procurement strategies for better outcomes.

Emphasis on Flexibility

Flexibility in budgeting has become a critical component of effective financial management. Market volatility, shifting priorities, and unforeseen disruptions demand budgeting solutions that can adapt quickly without compromising efficiency or strategic alignment. For instance, organizations facing sudden supply chain disruptions can reallocate funds to alternative suppliers or adjust production schedules without derailing their financial plans. Similarly, businesses exploring new market opportunities can dynamically shift resources to support innovation or expansion efforts. By adopting flexible budgeting approaches, organizations can enhance their resilience, mitigate risks, and seize new opportunities, all while maintaining a clear focus on long-term goals. This adaptability not only strengthens operational efficiency but also drives sustainable growth in an unpredictable environment.

Conclusion

Budgeting, particularly at the operational and capital levels, is fundamental to effective procurement management. Operational budgets facilitate the continuity of daily business activities, while capital budgets empower organizations to invest in transformative initiatives that drive future growth. A comprehensive understanding of these budget types not only ensures optimal resource alignment but also enhances strategic decision-making within a complex procurement landscape.

To remain competitive in an ever-evolving market, procurement professionals must stay abreast of emerging trends and adapt their budgeting strategies accordingly. This proactive approach enables organizations to capitalize on opportunities and effectively navigate challenges, ensuring sustainability and resilience in dynamic environments.

For organizations seeking to enhance their capital expenditure management, ProQsmart offers advanced solutions tailored to streamline the capital budgeting process. ProQsmart’s tools are designed to ensure that your investments align with strategic objectives and deliver long-term value. Take this opportunity to elevate your budgeting practices and secure a sustainable future for your organization with ProQsmart. Book a demo today!