Purchase to pay automation equips teams with the tools to remove all that time lost. It empowers systems to accurately streamline orders, bills, and payments in one integrated workflow.

By having clear processes for monitoring expenses, teams are able to identify mistakes quickly and maintain timely payments to vendors. It provides officials with concrete data, so they can budget more effectively and put money aside for a rainy day.

Teams are able to accomplish much more and miss much less. Up next, learn how automation really opens possibilities in custom manufacturing.

What is the Purchase to Pay Process?

The purchase-to-pay (P2P) process is a simple, automated approach to purchasing goods or services and paying for them. When procurement and accounts payable teams collaborate, they’re able to streamline the order process from beginning to end. This process begins with the purchase order request and concludes with the payment of the vendor.

We have automation today that takes time-consuming, manual processes out of the equation, expediting and simplifying the purchase to pay process.

Defining the P2P Cycle

The P2P cycle performs in a continuous loop, constantly seeking to improve upon every cycle. Each step— requisitioning, ordering, receiving, and paying— connects to the next one. When these processes—such as verifying invoices and receiving goods—are aligned, businesses are able to move operations more easily.

Fast and accurate processing ensures supplier satisfaction and contributes to overall supplier trustworthiness. Today’s technology, including the use of AI tools and EDI, allows teams to catch errors early and maintain a cycle of continuous improvement.

Core Stages: Requisition to Payment

The main stages are clear: ask for the item, get approval, send the order, check the invoice, and pay. With automation at every step, that means teams are spending less time and getting their documentation and funding mixed up.

For instance, AI-enabled software can match invoices with purchase orders and goods receipts, eliminating the need for manual entry. When all parties are using the same system, it becomes much easier to understand the current status and discuss any roadblocks.

Manual P2P: Common Pain Points

Many times, manual steps in this process delay payments and increase mistakes. Late payments, lost invoices, and general confusion over purchased items are a drain on both time and resources.

While outdated methods have gotten teams bogged down, newer omnichannel tools allow teams to catch up and get ahead.

Why Automate Your P2P Workflow?

Automating purchase-to-pay (P2P) workflows provides teams with a consistent, holistic view to oversee procurement operations from beginning to end. By implementing a comprehensive procure strategy that stores every record, document, and action in a central location, businesses make data retrieval much easier. This allows them to respond with urgency when something goes awry in their pay processes.

Those who’ve used pay software solutions know how dramatically these tools eliminate tedious, manual procurement systems. They further enhance visibility and collaboration across teams, leading to fewer errors, increased cash flow, and improved supplier relationships.

Automated systems such as ProQsmart utilize a versatile workflow automation solution to maximize smart decisions and streamline pay workflows. These innovations only reinforce how advanced these global platforms have already become.

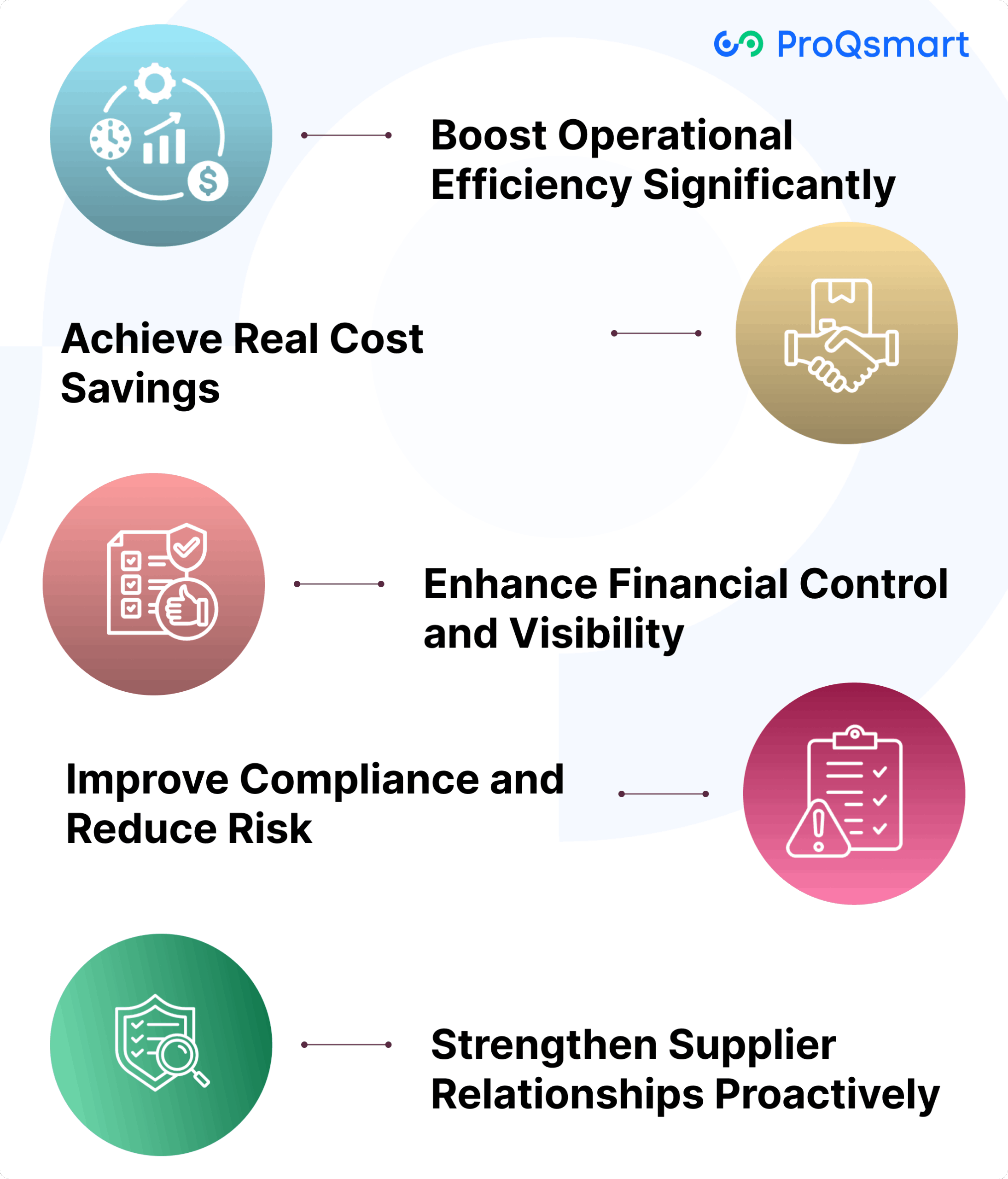

Boost Operational Efficiency Significantly

Automation reduces the time your staff spends on repetitive tasks, such as manual data entry or following up on approvals. Here’s how example automated approval workflows speed up purchases down the chain and ensure that everyone stays in the loop.

Teams collaborate easily. Teams collaborate effectively because everything they need is all in one system. With real-time tracking, you’ll know exactly where each order is at any moment, leaving no one to wonder or wait for an answer.

Bottlenecks disappear because automated alerts ensure approvals and payments are processed without delay.

Achieve Real Cost Savings

Automated P2P systems save costs by cutting down on manual labor and errors. According to studies conducted by the developers of these tools, companies that leverage them experience 33% reductions in duplicate or erroneous payments.

Centralized systems allow for better vendor selection and negotiating better contract terms by providing visibility into spend trends. Early payment discounts are much easier to realize with automated reminders that help ensure payments are made on time.

Greater spend visibility leads to more intelligent budgets, forecasts and planning across all departments.

Enhance Financial Control and Visibility

Automated tools provide near-immediate insight into cash flow and overall spending. With every piece of information located where it’s easily accessible, leaders can make quality strategic decisions quickly.

Robust reporting tools provide simple, real-time figures that allow for complete financial transparency. With automation, teams can more easily track compliance and budgets, especially identifying areas of concern before they escalate.

Improve Compliance and Reduce Risk

Automation maintains control by creating rules that automatically apply to each purchase. Inherent protections such as three-way matching—connecting purchase orders, invoices, and receipts—help prevent fraud and errors.

Since systems record each step automatically, audit and compliance checks are seamless. Regulatory compliance remains easy with proper, traceable documentation.

Strengthen Supplier Relationships Proactively

Automation helps pay suppliers on time and keeps them updated, building trust. When organizations share clear, consistent, real-time information, there is less confusion and delays for everyone involved.

Enhanced vendor management results in more favorable contracts and easier performance monitoring. This ensures that relationships with suppliers remain both robust and resilient.

Key Components of P2P Automation Systems

P2P automation systems combine technology and process to create an intelligent, end-to-end buying cycle. They combine not just e-procurement tools, but invoice processing, digital payments, contract management, and spend analysis. When all these pieces come together, teams experience reduced waste and increased velocity.

Intuitive dashboards and streamlined menus make it easier for staff to take to these systems with minimal time spent on training. Scalability makes a difference. As an organization scales, a mature P2P infrastructure effortlessly integrates additional vendors. It handles rising expenditure and new regulations with effortless aplomb.

E-Procurement and Requisitioning Tools

E-procurement tools eliminate time-consuming paperwork. They allow users to request items and route them for review in a few clicks. With defined spend caps and a digital paper trail, teams stay on budget.

Other tools, such as ProQsmart, connect directly to ERP systems.This produces up to hours of time and prevents the need for double entry. Digital requisition forms and workflow tools accelerate requests along, so projects continue to flow.

Automated Invoice Processing Solutions

With automated invoice tools, teams are able to substantially reduce manual errors. Invoicing & payment OCR scans paper or email invoices, extracting critical data and matching it to POs.

AI and RPA come to the rescue to identify odd charges and what’s out of place. Invoices routing for sign-off go according to established rules, so no invoices are sitting in limbo awaiting attention. This reduces cycle time and releases AP staff for other priorities.

Digital Payment Processing Methods

Digital payments, from ACH to virtual cards, fit seamlessly into P2P systems. They supplant slower checks and wires with quicker transfers.

With real-time tracking, project teams can easily understand what’s paid and what’s still pending. Secure payment flows, including OFAC checks, allow for automated systems to maintain supplier trust.

Contract Management Integration

Integrating contract management into the P2P process enables all related documents to be stored in a single location. Teams track contract terms, watch for deadlines, and check compliance.

Automated alerts are a great way to ensure that no one drops the ball. This minimizes risk and maximizes supplier performance.

Spend Analytics and Reporting Features

Analytics tools help identify wasteful spending, detect unusual purchases, and alert users to developing patterns. Dashboards provide at-a-glance, real-time views.

Automated reports continuously feed this data to leaders, which in turn allows them to make proactive and informed strategic moves. Having robust data on their off-policy spend allows them to go further and cut waste at the seams.

Implement P2P Automation Successfully

Here are three straightforward ways organizations that automate purchase-to-pay (P2P) processes realize significant benefits by taking a methodical step-by-step approach. It’s true, success does depend on aligning automation initiatives with organizational objectives, meticulous planning, and iterative development.

Furthermore, more than half of companies still do not automate procurement and AP, with only one-third of firms today using automation for these processes. That presents a significant unrealized potential to improve speed, control, and precision.

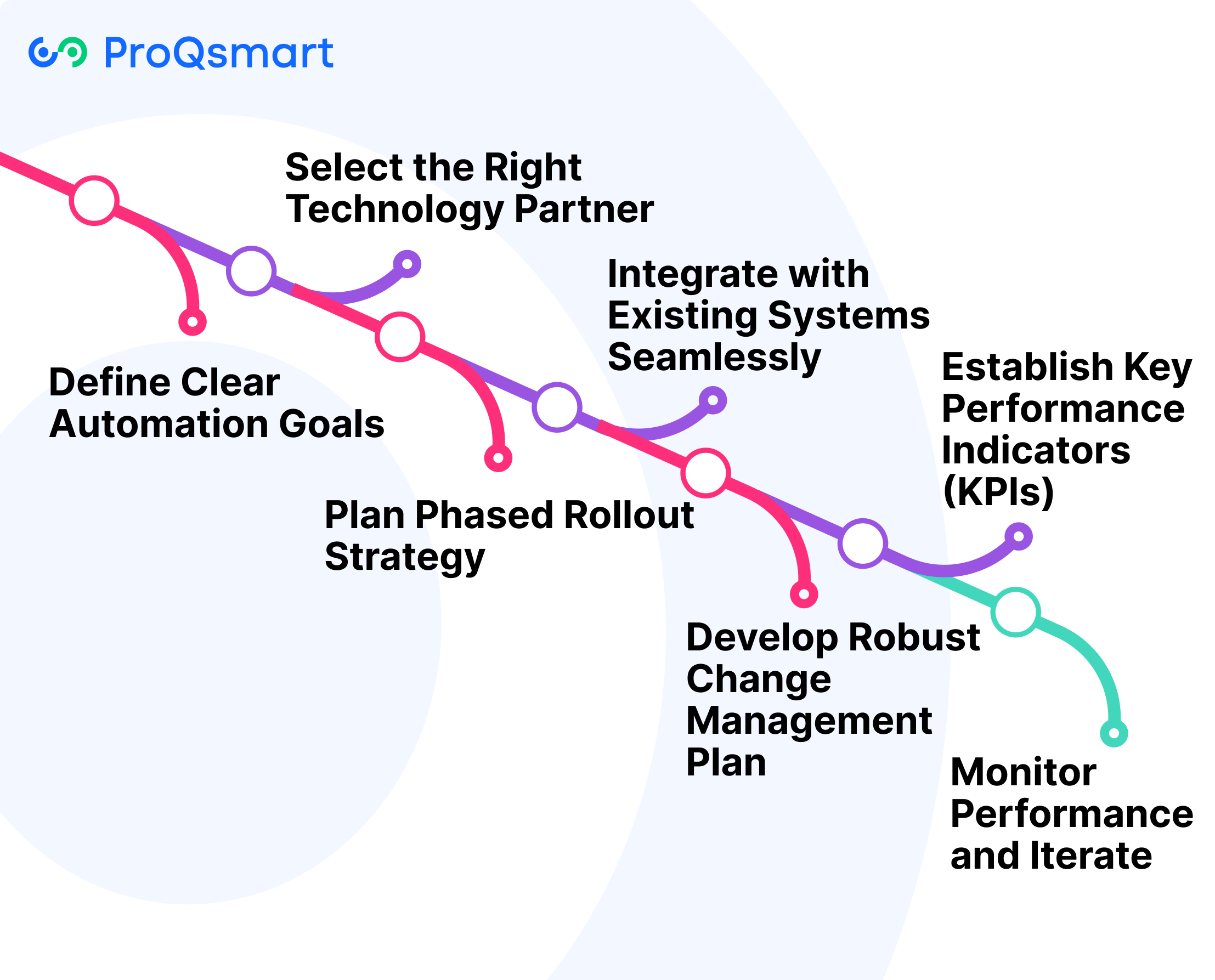

1. Define Clear Automation Goals

Teams begin by selecting the areas they are looking to improve with P2P automation, such as reducing invoice cycle time or improving spend visibility. Once their goals are defined, they can identify the tech that best aligns with their needs and overall strategy.

For instance, with ProQsmart, teams can automate complex workflows, keep budgets on track in real-time, and monitor supplier performance at-a-glance. Having measurable goals means it is easy to see progress—imagine time savings on approvals or less payment rejections due to wrong information.

2. Select the Right Technology Partner

When considering a tech partner, think about how their tools would plug into your existing tech stacks. Look at their industry knowledge and their customer service and support.

Solutions such as ProQsmart offer a rapid implementation with minimal disruption to current processes. Additionally, specialized onboarding teams help keep firms on their unusual processes. Vendor reputation and ongoing support is vital to keep maintained, running and growing smoothly.

3. Plan Phased Rollout Strategy

Taking a phased approach allows you to identify problems or unintended consequences before full rollout while providing users the opportunity to learn as they encounter use. Companies usually begin with AP automation, moving next to adding procurement or payment capabilities.

This gradual, phased plan makes alterations more digestible and allows for creating buy-in over time.

4. Integrate with Existing Systems Seamlessly

Ultimately, a powerful P2P solution should integrate and automatically sync with your ERP and/or finance tools, saving you time while ensuring easy, very accurate tracking. Payment systems and automatic payment (AP) tools automatically sync terms, credits, and discounts.

This provides certainty that the teams have the same, most current information as they move forward.

5. Develop Robust Change Management Plan

Amendment plans need to include engaging training, transparent ongoing communication, and an honest dialogue. By addressing concerns about the pay processes before they think to ask and providing reassurance, you establish credibility and accelerate buy-in.

6. Establish Key Performance Indicators (KPIs)

By using metrics such as invoice approval time and compliance rates, procurement departments gain insight into the performance of pay processes. Continuously reviewing KPIs helps ensure they remain top of mind, illustrating areas that need adjusting and enhancing procurement functions.

7. Monitor Performance and Iterate

Regular monitoring and evaluation of pay processes allow teams to identify areas of weakness and improve outcomes in the long run. Audits help ensure the procurement process remains focused on maintaining high standards while meeting the business necessity.

Overcome Common P2P Automation Hurdles

Commercial organizations across custom manufacturing frequently encounter tangible hurdles during the transition to purchase to pay (P2P) automation. Most are bogged down by tedious manual data entry that is both time consuming and error prone. Even with advanced tools like Optical Character Recognition (OCR) or intelligent document processing, teams still need to trust the process.

For most, the real value comes when automation stops incorrect invoices before they get paid or flags vendors who send repeat mistakes. By automating three-way matching, companies can dramatically reduce manual effort and the time it takes to identify and correct errors. This translates to quicker payments and additional discounts.

Address Resistance to Change Head-On

New technology implementations typically generate concerns among those responsible for workflow changes and daily operation of the new technology. What will win them over is demonstrating obvious advantages—such as reducing mistakes and eliminating busywork.

Allowing staff to be involved in choosing and testing the systems ensures buy-in. Open discussions about concerns and fears reduce negative responses to change. Leadership must create this tone by supporting a culture that embraces new tools.

Tackle System Integration Complexities

Connecting new automation tools with legacy ERP systems is par for the course, but it’s not always straightforward. Issues always arise when systems aren’t well integrated.

Involving the IT team from the get-go and piloting at each stage allows you to flush out bugs early in the process. Standardizing data between platforms is another important hurdle. ProQsmart, for example, boosts this with real-time workflow links, supplier tracking, and bill of quantities updates, helping teams see the whole picture.

Ensure Data Accuracy and Integrity

Smart automation equals smart data. Validating information prior to and following migration to new systems prevents data entry errors. Auditing consistently helps you avoid problems and identify issues that may still be sticking around.

Educating teams on these new data practices prevents costly errors and missteps.

Mitigate Security Vulnerabilities

Even the best automated P2P tools are only as secure as their locks. Risks such as data breaches or money laundering are pervasive. Two-step verification, regular system audits, and strong security protocols go a long way.

Educating staff to recognize scams or malicious links provides an additional layer of security.

Manage Supplier Onboarding Challenges

When it comes to onboarding new suppliers through automation, things start to get a bit more complicated. Providing clear application instructions and using smart form technology keeps your team organized and applicants on task.

Automated systems, such as ProQsmart, eliminate guesswork and simplify record-keeping, which makes onboarding a quicker, easier process. Continuous support makes for satisfied and invested suppliers.

Automation’s Impact Across Your Business

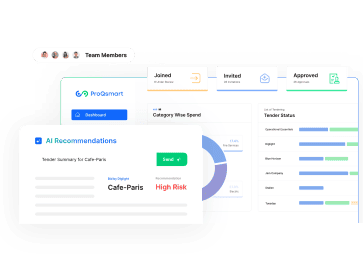

Implementing automation in purchase-to-pay (P2P) processes significantly influences the culture of internal teams, external supplier relationships, and the speed of overall operations. Teams from top to bottom realize massive benefits, especially when utilizing a robust pay software solution. In fact, companies deploying P2P automation are 68% more productive than organizations that continue to manage processes manually.

With ProQsmart, they don’t just get a tool – they gain access to an intelligence powerhouse. From e-tenders to managing suppliers and tracking in real-time, everything is available in one place, streamlining the pay workflow. That translates to fewer busywork tasks and more time to focus on the actual strategy.

Automation translates into order rogue purchases and better collaboration between procurement, finance, and other business units. These improvements position businesses for more advanced planning, speedier execution, and less disruptive expansion.

Empowering Procurement and Finance Teams

Automation handles the manual grunt work, such as generating purchase orders or matching invoices. It unburdens staff so that they can focus on more strategic work. When accounts payable and procurement teams have access to the same, up-to-the-minute data, they’re better equipped to plan and budget effectively.

ProQsmart’s automated workflows notify teams in real-time as conditions change, ensuring they’re making decisions based on data—not assumptions. The resulting dashboards from the software empower executive leaders to identify emerging trends or risks before they become systemic.

Transforming Vendor Interaction Dynamics

Automated P2P solutions ensure that supplier records are maintained and up-to-date, and they provide visibility into order statuses with vendors. When suppliers are paid immediately and have immediate visibility on where things are at, it builds trust and loyalty.

With tools such as ProQsmart’s supplier performance monitoring, the buyers and vendors are on the same page about what to expect. Digital document sharing and e-tendering ensure no one falls out of the loop, eliminating time-wasting delays. Your data remains clear and verifiable.

Accelerating Invoice Approval Times

Automation can significantly speed up time taken to review invoices by automating the routing of invoices quickly to the appropriate individuals in parallel. Status tracking lets finance and procurement know what’s paid or pending.

This rapid turnaround maintains contractor cashflow and ensures payment terms are met. On-time payments create strong vendor relationships and reduce the chance of conflicts in the future.

Future of Purchase to Pay Automation

Purchase to pay (P2P) automation is dramatically changing the way organizations approach procurement and accounts payable. Emerging trends and technology are pointing to a future of more efficient, connected workflows. Ultimately, this will reduce errors and free teams to focus on higher-value work.

Companies see lower manual error rates in invoicing—falling from 2% to 0.8%—and real-time data transfer between AP Automation and ERP systems means every update is current. Automation in P2P helps companies plan better, avoid stockouts, and free up teams from time-consuming tasks like matching POs to invoices.

AI and Machine Learning Influence

AI and machine learning are the foundation now for effective predictive analytics in P2P. Such tools assist in identifying trends in spending, alerting organizations to risky suppliers, and areas of opportunity for cost savings.

ProQsmart accelerates the supplier review process with the power of AI machine learning technology. It monitors supplier performance and automatically alerts when a contracted requirement is falling behind. Automation helps teams identify issues sooner and make quicker, better-informed decisions.

Just as importantly, the solution empowers AP personnel to move away from form-filling care to supplier relation building and discovering new savings.

Rise of Predictive Analytics

Intelligent, data-driven insights have transformed the process from sourcing to demand planning. Predictive analytics as part of P2P automation gives teams the ability to forecast supply requirements.

This method lowers overstock and assists in preventing late payments. That’s important because 40% of AP teams acknowledge that slow invoice approvals damage vendor relationships.

Automated systems, like those in ProQsmart, link to ERP and CRM tools, creating a clear view of spend, supplier quality, and compliance. This not only provides a more accurate view on tracking and planning for supply needs, but helps facilitate more strategic, quicker decisions.

Conclusion

Purchase-to-pay automation streamlines daily operations by eliminating time-consuming steps and reducing uncertainty in ordering and payment processes. This leads to faster order processing, fewer errors, and quicker identification of spending trends. With a complete audit trail, finance and procurement teams can approach audits and inspections confidently. Many organizations have adopted these intelligent systems to avoid late payment fees and maintain healthy cash flow. For example, a procurement manager can instantly access supplier performance metrics, enabling informed decisions on vendor selection and contract renewals. To stay competitive, businesses are implementing adaptive automation solutions that evolve with their needs.

To explore how accounts payable automation can benefit your organization, schedule a demo with ProQsmart today and start optimizing your sourcing process.